Lower your Chevrolet P30 Van Insurance Rates in Three Easy Steps

If buying car insurance was fun, we'd do it as a recreational sport. But in reality, the cost for insurance always seems too high and most people would prefer to get a root canal. You probably feel the same way when trying to find cheaper coverage for your Chevrolet P30 Van.

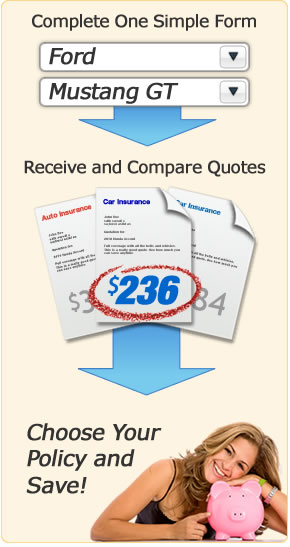

Step One: Insurance Quotes

Up until just recently, the only option you had for shopping for insurance was getting a high pressure sales pitch in the office of your local insurance agent. Not anymore!

Comparing apples-to-apples price quotes for your Chevrolet P30 Van is made easy by only requiring one form to be completed. This will shop your coverage with multiple companies and allow you to easily compare rates.

To start, click the link below to begin entering your information. After you complete the form, you will receive comparison rates from different companies so you easily determine if you can save money.

Important! If you already have liability and physical damage coverage on your P30 Van, it's important to keep the same limits and deductibles throughout the quote process. This allows you to fairly compare rates for many companies. If you use different limits and coverages for each quote, you won't be able to judge if the final rate is better or worse than other quotes.

Step Two: Top Ways to Get Lower P30 Van Insurance

Once you have quotes in hand, you can then consider some of the other techniques for lowering your P30 Van insurance rates.

- How is your credit rating? The better credit you have, the less insurance will cost for your P30 Van. If you have bad credit, work on improving your credit score and repair past credit problems.

- Comprehensive and collision coverages make up the majority of your car insurance bill. If you raise your deductibles, you can will see significant savings with every policy renewal.

- If you have tended to file small claims with your car insurance company in the past, you're most likely going to pay higher premiums in the future. Consider paying minor claims out-of-pocket instead of blemishing your claim history.

- Being a senior citizen can qualify you for a small discount on your insurance rates. Older drivers are generally more cautious so they get a lower rate.

- Speeding tickets and other violations can negatively impact your insurance rates for up to three years. Get too many tickets and you'll be shopping for a new car insurance company.

- If you've recently completed a driver's training or safety course, tell your insurance company. You may qualify for a 5-10% discount.

- Do not allow your current car insurance coverage to lapse or expire. Insurance companies have a simple way to find out when your last policy ended (called a CLUE report), and if you went without coverage for any length of time you may pay more for coverage.

- The advancement of car safety features such as traction control, stability control, front and side-impact air bags and all-wheel drive all help keep insurance costs down.

- For some reason, car theives target particular makes and models more than others. If your P30 Van is on the list of the top stolen cars, you might want to install an extra theft deterrent system just to be safe.

- If you have any teenage drivers in your household, expect to fork out quite a bit more for insurance. Rating them on a low profile vehicle with liability only coverage is the best way to save money.

- Homeowners often see a break on their car insurance rates because there is a correlation between owning a home and being a responsible driver.

Step Three: Purchase a New Policy

Buying a new car insurance policy is just a matter of finalizing your application form and submitting it with your down payment. Once payment has been accepted, coverage is bound the effective date shown on your application.

You can cancel a policy at any time, but just remember to make the effective date of the replacement policy the exact same as the date you cancel your old policy. You do not want any gaps in coverage between policies.

If you are adding a vehicle to an existing policy and not buying a new one, just make sure to get the vehicle added as soon as possible. Every insurance company offers a grace period to add new vehicles, so make sure you get the Chevrolet added prior to the expiration of this grace period. Anytime you buy a vehicle, you want to make sure coverage is in place before driving off the lot. If you have a policy now, you will have at least liability coverage. But if you don't insure any vehicles with full coverage, then you will put your new P30 Van at risk as soon as you drive away.

Once you finish buying your new policy, you will need to print out the proof-of-insurance card that is provided by your new company. This card is proof that you meet the state's minimum liability limits and is required to be kept in your vehicle. SR-22 filings are for high risk drivers and ensure that you have met your state's financial responsibility requirements. If you have DUI, DWI or uninsured accident convictions, you may have to file an SR-22 with your state DMV.

For More Information

For more information on car insurance, please visit the Insurance Information Institute's auto insurance informational page.