Find More Affordable Insurance for your Ferrari 348 TB

If shopping for auto insurance was more enjoyable, it would get done more often. But the premiums we pay always seem to be too high and most of use would rather get a tooth pulled. You might feel the same pain when having to pay the bill on your Ferrari 348 TB.

Step One: Compare Rates

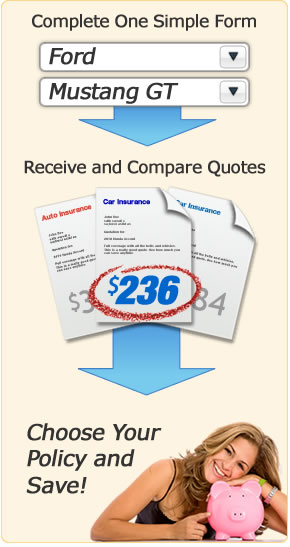

If you haven't priced insurance for awhile, you may still think that the only way to compare rates is to drive around town to multiple insurance offices and meet with an agent. But now you can eliminate that hassle and buy online!

You can compare insurance rates for a Ferrari 348 TB simply and quickly just by filling out one form. This allows you to quote the same coverages with multiple companies and pick the lowest rate.

Simply click the link below to enter your information. Once complete, you can compare the returned rates and make a decision on which policy to purchase.

Quote Tip! When doing car insurance quotes for your 348 TB, make sure you use the exact same values for coverages and deductibles. If you use different limits, you will not be able to fairly compare rates between different companies.

Step Two: Tried and True Ways to Save on 348 TB Insurance

Now that you have several rates to compare (since you did compare rates above, right?), we will now show you some additional ways you can lower your 348 TB insurance rates.

- Cheap insurance rates and high performance don't usually mix. If low rates are your goal, the Ferrari 348 TB is probably not the best vehicle due to it's above average performance.

- Being a senior citizen can qualify you for a small discount on your insurance rates. Older drivers are generally more cautious so they get a lower rate.

- OEM repair parts for the 348 TB cost more due to the higher quality. You will pay more for insurance because of this.

- One of the best ways to lower your insurance rates is to raise your credit score. Check your rating once a year and make sure to address any problem areas immediately.

- Sporty cars are fun to drive, and that's why you'll pay more for insurance. The tendancy to put the pedal down a little harder means a higher insurance rate for the 348 TB.

- If you've recently completed a driver's training or safety course, tell your insurance company. You may qualify for a 5-10% discount.

- The less chance of injury to passengers in an accident means lower insurance rates. Vehicles with safety features like side-impact airbags, head injury protection, antilock bracks and traction control generally will be cheaper to insure.

- If you carry full coverage on your vehicle, you can slash your rates by increasing your comprehensive and collision deductibles. You'll pay more out-of-pocket but you will save with every renewal.

- Vehicle thefts drive up the cost of everyone's insurance, but if your 348 TB is on the list of the most frequently stolen cars, you might be paying just a little extra.

- Try to maintain a claim-free discount on your car insurance policy. Obviously you can't prevent large claims, but if they are smaller and you can afford to pay them out-of-pocket, do so.

- Being a homeowner can often get you a little discount on your auto insurance. Insuring you home with the same company as your autos can often get you even deeper discounts.

- One of the easiest ways to keep your rates down is to drive safe. One speeding ticket can boost your rates for three years.

- Youthful or teen drivers that are rated on any vehicle will cost more. The inexperience and tendancy to enjoy going fast is a recipe for an accident.

- When buying a new policy, you do not want a gap in coverage. This lapse is viewed by insurance companies as a high risk, and you will pay more for your next policy.

Step Three: Choose the Right Company for You

Knowing which company to insure your 348 TB with is more than just choosing the lowest rate. You also need to be ready to put a down payment on your policy and make sure you have all the proper coverages in place.

Car insurance policies don't have to be cancelled at the renewal date, but just be sure the new policy starts the same day you cancel your old policy. This avoids any gaps in coverage between policies.

Any time you buy a new vehicle, make sure you have car insurance in place, either from an existing policy or a new policy that you purchase from the dealership floor. Most car insurance companies will extend coverage to newly purchased vehicles, but only up to the limits of the best insured vehicle. So if you only carry liability insurance and no physical damage coverage, your new purchase will be inadequately insured until you specifically add it to the policy with full coverage.

At the end of buying your policy, you will be able to print out a new proof-of-insurance card to place in your vehicle. This card is required by law and must be produced if requested by law enforcement. If you qualilfy as a high-risk driver after being convicted of a DUI, reckless driving or driving on a suspended license, you may be required to file an SR-22 with your state's DMV. Be sure your new car insurance company is aware of this filing requirement.

Additional Learning Resources

To find out more information such as auto insurance myths, rental car insurance and how to file a claim, visit the Insurance Information Institute website.