How to Lower Your GMC Sierra 3500HD Pickup Insurance Rates In Five Minutes or Less

If buying car insurance was fun, we'd do it as a recreational sport. But more than likely, it's challenging for most people and we always end up paying more than we want. Insuring your GMC Sierra 3500HD Pickup is probably no exception.

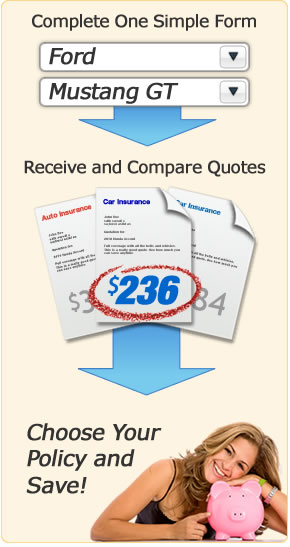

Step One: Insurance Quotes

If you haven't priced insurance for awhile, you may still think that the only way to compare rates is to drive around town to multiple insurance offices and meet with an agent. Now you can compare rates and buy a policy online!

You can now shop all the best car insurance companies and compare rates for a GMC Sierra 3500HD Pickup and you don't even have to visit each individual website!

To begin, click on the link below and complete the short form. It only takes a few minutes and it's helpful to have your current policy handy if you have one.

Important Tip! In order to accurately compare rates for your Sierra 3500HD Pickup, it's critical that you use the same limits and deductibles for liability and physical damage coverages like comprehensive and collision. If you use different limits, you will not be able to accurately compare rates between carriers.

Step Two: How to Cut Costs on Sierra 3500HD Pickup Insurance

Once you have quotes in hand, you can then consider some of the other techniques for lowering your Sierra 3500HD Pickup insurance rates.

- Reduce your rates by buying a car that is not a hot model for car thieves. Certain makes and models are more tempting than others, and high-frequency stolen vehicles get charged a higher rate.

- Membership has it's privleges. If you're a member of a professional organization, check to see if your company offers discounts to its members. It can add up to 5% or more.

- If you have tended to file small claims with your car insurance company in the past, you're most likely going to pay higher premiums in the future. Consider paying minor claims out-of-pocket instead of blemishing your claim history.

- Owning a home takes financial responsibility, and car insurance companies will often give you a break just for being a homeowner.

- If your GMC is equipped with safety features such as airbags, anti-lock brakes or a security system, insurance companies will often give a minor discount for those.

- Do not allow your current car insurance coverage to lapse or expire. Insurance companies have a simple way to find out when your last policy ended (called a CLUE report), and if you went without coverage for any length of time you may pay more for coverage.

- Speeding and other minor violations can impact your car insurance rates for up to three years. The increased cost can easily exceed the fine and court costs for the original ticket.

- Successfully completing a driver's training class can help lower your rates if your insurance company offers that discount.

- Youthful or teen drivers that are rated on any vehicle will cost more. The inexperience and tendancy to enjoy going fast is a recipe for an accident.

- How's your credit score? If it's good you will pay a lower rate than your poor credit counterparts. Work on improving weak credit and you will eventually see your car insurance bill go down.

- You can save money on your physical damage coverage (comprehensive and collision) by increasing your deductibles. Higher deductibles mean you are willing to pay more before the insurance company covers a claim.

Step Three: Choose a Company and Bind Coverage

You've compared rates and hopefully looked over the coverages for each vehicle on your policy to make sure they're adequate. Now you can make the big decision on which company will best fulfill your needs.

The key thing to keep in mind when buying a new policy is you do not want your old policy to lapse. Make sure the effective date of the new policy is on or before the expiration date of your current policy.

If the GMC Sierra 3500HD Pickup is a new purchase and you already have car insurance, then you will have some coverage that extends to the vehicle. But if you let your old policy lapse or have never had coverage, you don't have any protection once you buy the vehicle. Most car insurance companies will extend coverage to newly purchased vehicles, but only up to the limits of the best insured vehicle. So if you only carry liability insurance and no physical damage coverage, your new purchase will be inadequately insured until you specifically add it to the policy with full coverage.

Once you have purchased your policy, print out the insurance card that must go in your vehicle. This card fulfills the state law requiring you to prove financial responsibility. If you qualilfy as a high-risk driver after being convicted of a DUI, reckless driving or driving on a suspended license, you may be required to file an SR-22 with your state's DMV. Be sure your new car insurance company is aware of this filing requirement.

Additional Learning Resources

The Insurance Information Institute has a great resource of car insurance articles where you can learn more about coverages and money saving tips. Visit iii.org.