How to Find Affordable Insurance for your Lincoln Navigator L

If finding the lowest rate on car insurance was easy, most people would have no trouble paying less. But the reality is, you probably don't enjoy it and you think it costs too much. Cutting the check for each renewal on your Lincoln Navigator L might give you the same feeling.

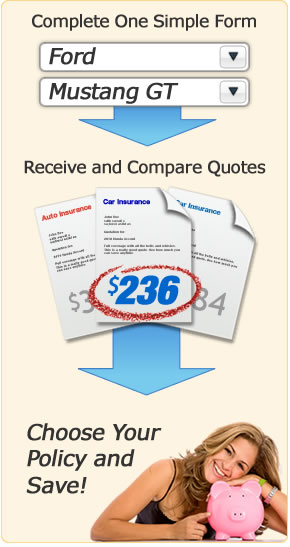

Step One: Compare Online Rate Quotes

If you haven't shopped for car insurance for awhile you might remember the days when the only option was to visit a local insurance agent. Now you can compare rates and buy a policy online!

Comparing insurance rates for a Lincoln Navigator L only require you to enter your information once. You'll receive multiple quotes and can easily compare rates.

Simply click the link below to enter your information. Once complete, you can compare the returned rates and make a decision on which policy to purchase.

Quote Tip! In order to accurately compare rates for your Navigator L, it's critical that you use the same limits and deductibles for liability and physical damage coverages like comprehensive and collision. If you use different limits, you will not be able to accurately compare rates between carriers.

Step Two: Insider Tips for Finding Cheaper Navigator L Insurance

How much impact insuring your Lincoln has on your wallet is controlled by many different factors. Here are some ways to reduce the negatives and improve the positives.

- Having recently completed a class in driver's safety could earn you a discount of 5% to 10%. Check with your insurance company to see if they offer that credit.

- The Navigator L would be considered a luxury vehicle, and repair costs are generally higher for more expensive vehicles. This increased cost is passed on to you through a higher insurance cost.

- If you belong to a professional organization for your employment, you may qualify for a discount rate. And if you're a senior citizen, you may get a discount for your age as well.

- Since you're insuring a SUV, you will pay a little more due to the increased risk of rollover and a more complex power train.

- Teen drivers are expensive to insure and the only way to lower your rates is to rate them on an older vehicle with basic liability coverage.

- Smaller claims that hardly exceed your deductible are better off not being filed with your insurance company. Policyholders with no claims enjoy lower rates than those who frequently file claims.

- Each year make a habit of checking your credit score. If you find problems that may be dragging down your credit rating, address them immediately. This will result in significant savings on car insurance.

- Renting a house or apartment rather than owning a home may keep you from paying the lowest rates on car insurance. Home ownership is viewed as being more financially responsible than renting.

- A deductible is the amount you pay before your company pays a comprehensive or collision claim. If you increase your deductibles, you will pay less for these coverages.

- Most Lincoln vehicles come with standard safety features such as air bags and passive restraints, and those will help keep your insurance costs down.

- If you think the only financial impact of a speeding ticket is a fine and court costs, think again. Insurance companies will raise your rates for up to three years for a single ticket.

- Allowing your insurance to lapse for any length of time will increase the cost of a new policy. Always keep coverage in force.

- Insurance companies pay attention to which vehicles are stolen the most, so if your car is frequently targeted by thieves, chances are good you will pay more for insurance if you live in certain parts of the country.

Step Three: Finalize your Policy Details

Now that you hopefully have several rates to compare and have made any changes needed to your individual coverages, you can choose the best company to insure your Navigator L with.

It's critical that your new policy starts the same day that your old policy ends. If you are cancelling mid-term, make sure there is no lapse in coverage before your new policy kicks in.

If the Lincoln Navigator L is a new purchase and you already have car insurance, then you will have some coverage that extends to the vehicle. But if you let your old policy lapse or have never had coverage, you don't have any protection once you buy the vehicle. Coverage that extends from an existing policy is only as good as your current coverage. So if you don't carry full coverage on any vehicles, you won't have it on your new Navigator L.

All states require you to keep the proof-of-insurance or financial responsibility card in your vehicle at all times. Failure to produce this document can result in a citation. If you have received a DUI, reckless driving citation or caused an accident without insurance, you may be required to file an SR-22 with your state DMV. Make sure your new company is aware of the SR-22 filing requirement.

More Resources

To do more research on car insurance, visit the Insurance Information Institute website.