How to Insure your Nissan NV1500 on a Budget

If shopping your car insurance around was fun, we'd do it much more often. Unfortunately, it's not always as easy as it sounds to get the best rate. Finding insurance for your Nissan NV1500 that you can actually afford is probably no different.

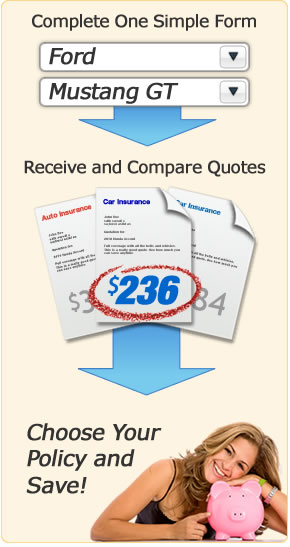

Step One: Insurance Rate Comparison Quotes

Up until about ten years ago, the only way to shop for car insurance was in the office of a local insurance agent where you'd get a hard sell into a policy. Times have changed!

All the major car insurance companies sell insurance for a Nissan NV1500 and you can compare their rates by entering your information only one time.

Simply click the link below to enter your information. Once complete, you can compare the returned rates and make a decision on which policy to purchase.

Read this (it's important)! When doing any car insurance quote to compare rates to either your existing policy or to other quotes, it's important to use identical coverages on all quotes. Otherwise you will not be able to accurately determine which company has the lowest rate for your NV1500.

Step Two: Tricks to Saving Money on NV1500 Insurance

There are many contributing factors that determine what you pay to insure your Nissan. You can help yourself (and your wallet) by paying attention to the following rate factors.

- If you have a high credit score, you will be rewarded with lower insurance rates. Conversely, if your credit rating is on the low site, your rates will be higher.

- Most of us have received a ticket at one time or another. If you get a ticket for a minor violation, find out if there is a safe driving class you can take to keep the ticket off your driving record.

- Being a homeowner can often get you a little discount on your auto insurance. Insuring you home with the same company as your autos can often get you even deeper discounts.

- If you have any teenage drivers in your household, expect to fork out quite a bit more for insurance. Rating them on a low profile vehicle with liability only coverage is the best way to save money.

- If switching companies, always have the effective date of the new policy be identical to the expiration date on the old policy. This prevents a lapse in coverage and companies charge higher rates if you have any lapses.

- Try to maintain a claim-free discount on your car insurance policy. Obviously you can't prevent large claims, but if they are smaller and you can afford to pay them out-of-pocket, do so.

- Many insurance companies will give you a small discount if you've recently completed a driver's training course.

- Safety features such as antilock brakes, traction control and air bag systems all help reduce the cost of car insurance by keeping the passengers safer.

- Members of many professional organizations can receive discounts on car insurance, and if you're a senior citizen, that could earn you an additional discount.

- If your NV1500 ranks on the list of vehicles that are frequently stolen, that can result in a higher rating class and a more expensive rate.

- Comprehensive and collision coverages make up the majority of your car insurance bill. If you raise your deductibles, you can will see significant savings with every policy renewal.

Step Three: Bind Coverage and Cancel your Old Policy

It's time to make a purchase decision based on your rate comparisions and and any policy coverage changes you wish to make. Once you are comfortable with the cost and coverages, you can finalize your purchase by paying your premium down payment.

If you didn't have a prior policy, then you can make the new policy effective any time. But if you're moving bewteen companies and don't want a lapse in coverage, make sure the effective date of the new policy is exactly the same as the cancellation date of the old policy.

If this is a new policy with only the Nissan on it, be sure to have coverage before leaving the dealership or car lot. If you're adding it to an existing policy, you have anywhere from 15 to 30 days depending on the company. When driving off the lot, you may have coverage that extends from your current policy. But it will only be equal to the most coverage you have on any vehicle. So if you only carry liability coverage, you won't be covered for full coverage until you specify it on your policy.

After completing your policy purchase, you can print out the proof-of-insurance card to place in your car. Always keep the current card available in case requested by law enforcement or if you are in an accident. High risk drivers may be required to submit an SR-22 with their state DMV's. If you have been convicted of reckless driving, DUI or had an uninsured accident, you may qualify. Make sure your new policy reflects the need for the SR-22 filing.

More Resources for Insurance Buying

To read more about filing a claim, choosing replacement parts, rental car insurance and more, visit the Insurance Information Institute.