How to Lower Your Suzuki Swift Insurance Rates In Five Minutes or Less

If we enjoyed shopping for car insurance, we'd do it more often. But it's actually not a real enjoyable process for the majority of people and we always seem to end up paying too much. Cutting the check for each renewal on your Suzuki Swift might give you the same feeling.

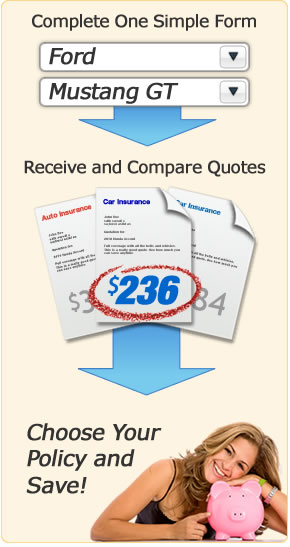

Step One: Get Insurance Quotes

Years ago, your local insurance agent was the only way to quote a buy a car insurance policy. But now you can eliminate that hassle and buy online!

Comparing apples-to-apples price quotes for your Suzuki Swift is made easy by only requiring one form to be completed. This will shop your coverage with multiple companies and allow you to easily compare rates.

Take the first step by clicking the link below. By answering a few questions you'll be able to compare rates quickly and easily.

Important Tip! In order to accurately compare rates for your Swift, it's critical that you use the same limits and deductibles for liability and physical damage coverages like comprehensive and collision. If you use different limits, you will not be able to accurately compare rates between carriers.

Step Two: Best Ways to Lower your Swift Insurance Cost

After completing step one and having some rates to compare, you can now focus on policy and lifestyle modifications that will lower your Swift insurance rates.

- One of the best ways to lower your insurance rates is to raise your credit score. Check your rating once a year and make sure to address any problem areas immediately.

- A single speeding ticket can cost you several hundreds of dollars over the next three years thanks to increased car insurance rates. Slow down and drive safely.

- If you own a home, you may get a break on your car insurance. Home ownership demonstrates financial responsibility.

- Teen drivers have a tendancy to learn the hard way when driving, and that means having a few fender-benders. Rating them on a high profile newer vehicle can be very expensive so you might consider buying an older model vehicle for them to drive and only insure it with liability coverage.

- Letting your car insurance expire without having new coverage in place is called a "lapse" and will cause your next policy premiums to be higher.

- Small claims that may only exceed your physical damage deductibles by a small amount are better off not being submitted to your company. Just pay the extra hundred dollars or two and keep a claim-free discount on your policy.

- Successfully completing a driver's training class can help lower your rates if your insurance company offers that discount.

- Newer car models are coming standard with advanced passenger safety systems, and these help reduce the risk of injury in an accident. Less injuries mean lower insurance rates.

- Car insurance disounts for senior citizens are often offered by companies as well as discounts for belonging to a professional organization.

- Auto theft is a big problem that costs us all money, but if your car is on the list of the most frequently stolen autos, you might be paying a little extra because of the temptation to thieves.

- You can save money on your physical damage coverage (comprehensive and collision) by increasing your deductibles. Higher deductibles mean you are willing to pay more before the insurance company covers a claim.

Step Three: Finalize your Policy Details

Purchasing an insurance policy is more than just clicking a button. You need to have funds available to make payment and you need to be sure that the coverages are adequate for your personal situation.

It's critical that your new policy starts the same day that your old policy ends. If you are cancelling mid-term, make sure there is no lapse in coverage before your new policy kicks in.

Any time you buy a new vehicle, make sure you have car insurance in place, either from an existing policy or a new policy that you purchase from the dealership floor. Comprehensive (or Other than Collision) and collision coverage will extend to your new Swift if you current have a vehicle insured with those coverages. If you aren't insured or only carry basic liability coverage, then you will be inadequately insured until you add the vehicle to your policy with full coverage.

Once you finish buying your new policy, you will need to print out the proof-of-insurance card that is provided by your new company. This card is proof that you meet the state's minimum liability limits and is required to be kept in your vehicle. If you're considered a high-risk driver, having been convicted of a DUI, DWI, reckless driving or had your license suspended, you may need to file a SR-22. Be sure your new company files this form with your state DMV. Failure to do so can result in losing your right to drive.

Consumer Insurance Information

The Insurance Information Institute has a great resource of car insurance articles where you can learn more about coverages and money saving tips. Visit iii.org.