Tightwads Guide to Insuring a Volkswagen Eurovan

If shopping for auto insurance was more enjoyable, it would get done more often. But we always seem to pay too much for coverage and most people would rather go to the dentist. Finding good insurance for your Volkswagen Eurovan probably leaves you feeling the same way.

Step One: Compare Rates

Up until about ten years ago, the only way to shop for car insurance was in the office of a local insurance agent where you'd get a hard sell into a policy. Now that we have the internet, shopping for car insurance online is a snap!

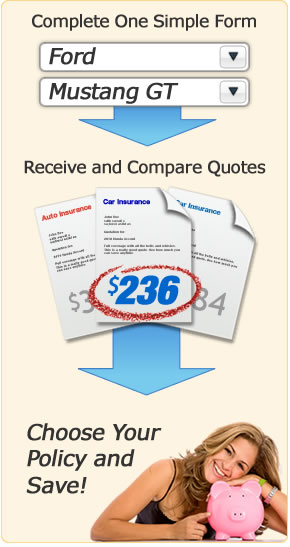

You can compare insurance rates for a Volkswagen Eurovan simply and quickly just by filling out one form. This allows you to quote the same coverages with multiple companies and pick the lowest rate.

Compare rates now by clicking the link below. In just a few minutes you'll have a good idea of what insurance will cost for your Volkswagen Eurovan.

Quoting Tip! The only way to compare rates from multiple companies is to use identical coverage amounts and deductibles on each quote. If you use different limits on quotes, you cannot accurately determine which company has the best rates for your Eurovan.

Step Two: Techniques to Lower your Eurovan Insurance Rates

Now that you have several rates to compare (since you did compare rates above, right?), we will now show you some additional ways you can lower your Eurovan insurance rates.

- The time it takes to complete a driver's safety training course could be time well spent. It could save you up to 10% off your car insurance rates.

- Being a senior citizen can qualify you for a small discount on your insurance rates. Older drivers are generally more cautious so they get a lower rate.

- If you have any teenage drivers in your household, expect to fork out quite a bit more for insurance. Rating them on a low profile vehicle with liability only coverage is the best way to save money.

- Small claims that may only exceed your physical damage deductibles by a small amount are better off not being submitted to your company. Just pay the extra hundred dollars or two and keep a claim-free discount on your policy.

- How's your credit score? If it's good you will pay a lower rate than your poor credit counterparts. Work on improving weak credit and you will eventually see your car insurance bill go down.

- Bundling your auto and home insurance with the same company can often get you a discount, and just being a homeowner in itself will get you a lower rate.

- If you're willing to shoulder more of the cost at claim time, consider raising your comprehensive and collision deductibles. This can easily cut 30% or more from your policy premium.

- Safety features such as antilock brakes, traction control and air bag systems all help reduce the cost of car insurance by keeping the passengers safer.

- One of the easiest ways to keep your rates down is to drive safe. One speeding ticket can boost your rates for three years.

- Letting your car insurance expire without having new coverage in place is called a "lapse" and will cause your next policy premiums to be higher.

- Particular years and models of cars tend to be frequently stolen, and if your Eurovan is on that list, chances are your insurance company knows it and will ding you a little extra because of it.

Step Three: Buy the Best Policy

Car insurance is pretty easy to buy online, but you do need to be aware that it is a legally binding contract. You need to have funds available for a down payment as well as review your coverages for any insufficiencies.

Make sure to avoid any lapse in coverage by setting the new policy's effective date to be the same date you cancel your old policy. Otherwise you could be driving without any coverage.

Coverage will extend from your current policy if you're buying a Volkswagen Eurovan, but if you don't have a policy, you will need to make sure you have coverage in place before you drive it off the dealership lot. When driving off the lot, you may have coverage that extends from your current policy. But it will only be equal to the most coverage you have on any vehicle. So if you only carry liability coverage, you won't be covered for full coverage until you specify it on your policy.

At the end of buying your policy, you will be able to print out a new proof-of-insurance card to place in your vehicle. This card is required by law and must be produced if requested by law enforcement. High risk drivers may be required to submit an SR-22 with their state DMV's. If you have been convicted of reckless driving, DUI or had an uninsured accident, you may qualify. Make sure your new policy reflects the need for the SR-22 filing.

More Resources for Insurance Buying

To read more about topics such as how to file a claim, replacement auto parts and mistakes to avoid, visit the Insurance Information Institute website.