Three Steps to Cheaper Mercedes-Benz R500 Insurance

If shopping for auto insurance was more enjoyable, it would get done more often. But the reality is, you probably don't enjoy it and you think it costs too much. Finding affordable coverage for your Mercedes-Benz R500 probably is no different.

Step One: Compare Rates

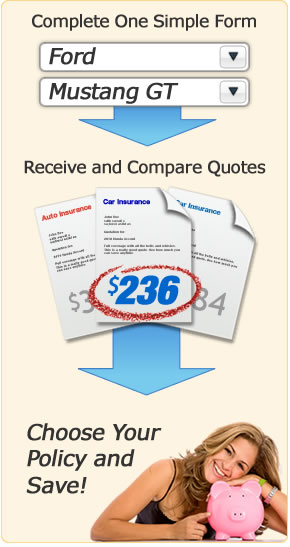

The old-fashioned method of shopping for car insurance included visiting several local insurance agents and being on the receiving end of a hard sell tactic. Thanks to the internet, insurance shopping is a whole lot easier!

The best car insurance companies offer online quoting for a Mercedes-Benz R500 and it's very easy to compare different rates by only using one form.

Compare rates now by clicking the link below. In just a few minutes you'll have a good idea of what insurance will cost for your Mercedes-Benz R500.

Apples-to-Apples! When doing comparison quotes for your R500, it's very important that you use the same liability limits and physical damage deductibles on each quote. Otherwise you will not be able to accurately determine which company has the lowest rates.

Step Two: Insider Tips for Finding Cheaper R500 Insurance

Now that you have several rates to compare (since you did compare rates above, right?), we will now show you some additional ways you can lower your R500 insurance rates.

- Some people just like the looks of a higher performance vehicle like the Mercedes-Benz R500, but even if you don't use the extra power it's going to cost you more when your insurance bill arrives.

- Insurance companies often give discounts to senior citizens and professional organizations, so if you're one of those, check to see if you qualify.

- The more a vehicles costs new, the more likely it is that repairs will cost more as well. Since the R500 is a luxury crossover vehicle insurance will cost a little more.

- Do you keep your credit rating in good shape? If you do, you will get a better rate than if you let your credit score slide. Check your credit score regularly to make sure there are few blemishes on your record.

- If you've recently completed a driver's training or safety course, tell your insurance company. You may qualify for a 5-10% discount.

- Safety features such as passive restraints and air bag systems help reduce injuries in and accident, and car insurance companies will charge lower rates if these features are present.

- Comprehensive and collision coverages make up the majority of your car insurance bill. If you raise your deductibles, you can will see significant savings with every policy renewal.

- For some reason, car theives target particular makes and models more than others. If your R500 is on the list of the top stolen cars, you might want to install an extra theft deterrent system just to be safe.

- To keep your rates low, don't file excessive claims on your policy. Insurance is meant to cover large losses, not small damage that you can pay for out-of-pocket.

- Homeowners often see a break on their car insurance rates because there is a correlation between owning a home and being a responsible driver.

- Minor driving violations such as speeding tickets can cause your rates to go up. Too many violations in a short period of time will cause your policy to be non-renewed.

- The easiest way to INCREASE your car insurance rates is to add a teenage driver to your policy. There aren't many ways to prevent a rate increase, but if you can rate them on an older vehicle, it can help.

- If you have a period where you don't have any insurance coverage, that's called a lapse. The longer the lapse, the more you'll pay to reinstate coverage.

Step Three: Buy the Policy That's Right for You

Now that you hopefully have several rates to compare and have made any changes needed to your individual coverages, you can choose the best company to insure your R500 with.

If you're cancelling an old policy, make sure the new coverage starts the same day your old policy ends. This avoids any penalty for having a lapse in coverage which can cost you more.

If you already have a car insurance policy, then your Mercedes-Benz R500 will be covered as soon as your purchase it. If this is your first vehicle, you will want to make sure you have coverage in place as soon as your purchase it. The coverage extended to an add-on vehicle is only as good as the coverage on existing vehicles, so if none of your current insured vehicles have full coverage, your new R500 won't have it either. So in that case, it's important to call your agent or company directly from the dealership and have them bind coverage immediately.

Once your new policy has been purchased, you are required to keep the proof-of-insurance card in your vehicle at all times. This is required by state law and you can receive a citation if you cannot provide it. If you are required to file an SR-22 with your state, your new insurance company will take care of that for you. If you cancel your coverage for any reason, you risk the loss of your driver's license.

Other Insurance Resources

For more information on car insurance topics like the claims process, rental car insurance and how much coverage you need, visit the Insurance Information Institute website.