How to Find Affordable Insurance for your Mercury Tracer

If finding the lowest rate on car insurance was easy, most people would have no trouble paying less. But the reality is, it's a chore for most people and we seem to always end up paying more than we want to. Finding good insurance for your Mercury Tracer probably leaves you feeling the same way.

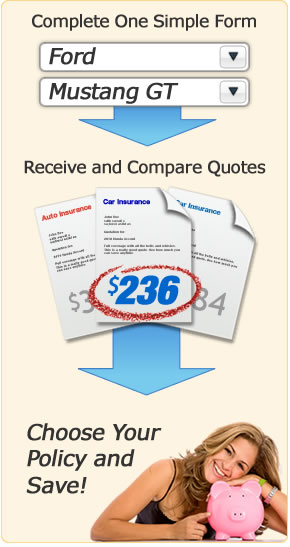

Step One: Compare Online Rate Quotes

Years ago, your local insurance agent was the only way to quote a buy a car insurance policy. But now you can eliminate that hassle and buy online!

You can compare insurance rates for a Mercury Tracer simply and quickly just by filling out one form. This allows you to quote the same coverages with multiple companies and pick the lowest rate.

To begin, click on the link below and complete the short form. It only takes a few minutes and it's helpful to have your current policy handy if you have one.

Quote Tip! In order to accurately compare rates for your Tracer, it's critical that you use the same limits and deductibles for liability and physical damage coverages like comprehensive and collision. If you use different limits, you will not be able to accurately compare rates between carriers.

Step Two: How to Insure your Tracer for Less

How much impact insuring your Mercury has on your wallet is controlled by many different factors. Here are some ways to reduce the negatives and improve the positives.

- Being a senior citizen can qualify you for a small discount on your insurance rates. Older drivers are generally more cautious so they get a lower rate.

- Before a comprehensive or collision claim is paid by your company, you have to pay a deductible first. The more you're willing to pay, the lower your rates will be. Consider raising your deductibles to $500 or even $1,000.

- Teen drivers are expensive to insure and the only way to lower your rates is to rate them on an older vehicle with basic liability coverage.

- If you have a speeding ticket or other moving violation, you could be charged more for insurance. If you get a ticket, find out if your county or state offers a defensive driving course that will void the ticket upon completion.

- Safety features such as passive restraints and air bag systems help reduce injuries in and accident, and car insurance companies will charge lower rates if these features are present.

- Smaller claims that hardly exceed your deductible are better off not being filed with your insurance company. Policyholders with no claims enjoy lower rates than those who frequently file claims.

- If you car makes the top ten list of most stolen cars, you might be paying a little extra to insure it.

- Do you keep your credit rating in good shape? If you do, you will get a better rate than if you let your credit score slide. Check your credit score regularly to make sure there are few blemishes on your record.

- Successfully completing a driver's training class can help lower your rates if your insurance company offers that discount.

- When buying a new policy, you do not want a gap in coverage. This lapse is viewed by insurance companies as a high risk, and you will pay more for your next policy.

- Most insurance companies will give you a discount on your car insurance if you also own a home. Some go even farther and give you discounts if you package your homeowners and auto insurance with them.

Step Three: Buy the Best Policy

Once you have compared identical rate quotes for your Tracer and made a decision on deductibles, coverages and other policy options, you are ready to buy your policy with the new company.

Make sure to avoid any lapse in coverage by setting the new policy's effective date to be the same date you cancel your old policy. Otherwise you could be driving without any coverage.

Any time you buy a new vehicle, make sure you have car insurance in place, either from an existing policy or a new policy that you purchase from the dealership floor. Comprehensive (or Other than Collision) and collision coverage will extend to your new Tracer if you current have a vehicle insured with those coverages. If you aren't insured or only carry basic liability coverage, then you will be inadequately insured until you add the vehicle to your policy with full coverage.

At the end of buying your policy, you will be able to print out a new proof-of-insurance card to place in your vehicle. This card is required by law and must be produced if requested by law enforcement. If you're considered a high-risk driver, having been convicted of a DUI, DWI, reckless driving or had your license suspended, you may need to file a SR-22. Be sure your new company files this form with your state DMV. Failure to do so can result in losing your right to drive.

Consumer Insurance Information

To do more research on car insurance, visit the Insurance Information Institute website.