Cheaper Plymouth Breeze Insurance in Five Minutes or Less

If buying auto insurance was as easy as it sounds on TV commercials, we'd have no problem getting the lowest rates. But most likely we pay more than we want to and don't really enjoy the buying process. Finding affordable insurance for your Plymouth Breeze is probably the same story.

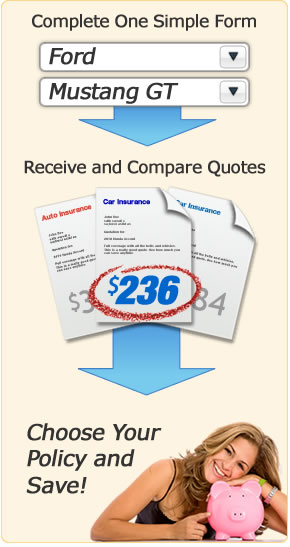

Step One: Compare Multiple Rate Quotes

In years past, the only way to purchase car insurance was to visit the office of a local agent. But now you can eliminate that hassle and buy online!

Almost every car insurance company now offers online quotes, and you can actually get insurance quotes for a Plymouth Breeze without even visiting their websites!

To begin, click on the link below and complete the short form. It only takes a few minutes and it's helpful to have your current policy handy if you have one.

Quote Tip! When doing car insurance quotes for your Breeze, make sure you use the exact same values for coverages and deductibles. If you use different limits, you will not be able to fairly compare rates between different companies.

Step Two: How to Lower your Breeze Insurance Premium

If you have completed step one above (if not, please complete that step first), then you are now ready to learn some ways to insure your Breeze that will also lower the rate you pay irregardless of which company you choose.

- One of the best ways to lower your insurance rates is to raise your credit score. Check your rating once a year and make sure to address any problem areas immediately.

- If you have a speeding ticket or other moving violation, you could be charged more for insurance. If you get a ticket, find out if your county or state offers a defensive driving course that will void the ticket upon completion.

- Owning a home takes financial responsibility, and car insurance companies will often give you a break just for being a homeowner.

- Teenage drivers can be very expensive to insure on newer vehicles will full coverage. You may be better off purchasing an older vehicle for your teenager and only insure it for liability.

- Allowing your insurance to lapse for any length of time will increase the cost of a new policy. Always keep coverage in force.

- Filing small claims will get you into hot water with your insurance company. Frequent filers will often find themselves either paying higher rates or non-renewed at renewal time.

- Successfully completing a driver's training class can help lower your rates if your insurance company offers that discount.

- Safety features such as passive restraints and air bag systems help reduce injuries in and accident, and car insurance companies will charge lower rates if these features are present.

- If you are a senior citizen or belong to a particular professional organization, you may qualify for a break on insurance.

- Thieves tend to steal certain makes and models of vehicles more than others, and if your car is on that list, expect to pay higher insurance rates because of it.

- Consider raising your comprehensive and collision deductibles if you carry full coverage. By accepting more risk yourself, your car insurance company will cut you a break on your physical damage premiums.

Step Three: Finalize your Car Insurance Policy

Choosing a new car insurance company is not easy. But hopefully you have a handful of quotes for your Breeze that will give you a good idea of how much it will cost, as well as some idea of any coverage changes you may want to make.

An important thing to keep in mind when buying a new policy is you want the effective date of the new policy to be the exact same as the date you are cancelling your old policy.

Any time you buy a new vehicle, make sure you have car insurance in place, either from an existing policy or a new policy that you purchase from the dealership floor. If you have a current policy and you only carry liability coverage, then that's the only coverage that will automatically extend to your Breeze. But if you currently carry full coverage, comprehensive and collision coverage will extend to your new vehicle.

Your insurance company will provide you with proof-of-insurance forms to keep in your vehicle. It's required by state law to carry at least the state minimum liability limits. If your state requires you to file an SR-22 for being a high-risk driver, make sure your new company is aware of this requirement. Failure to comply can result in loss of your driver's license.

More Insurance Buying Tips

To find out more information such as auto insurance myths, rental car insurance and how to file a claim, visit the Insurance Information Institute website.