How to Insure your Toyota Highlander on a Tight Budget

If finding the lowest rate on car insurance was easy, most people would have no trouble paying less. But the reality is, you probably don't enjoy it and you think it costs too much. Finding affordable insurance for your Toyota Highlander is probably the same story.

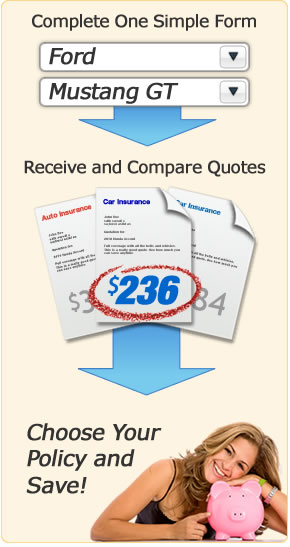

Step One: Compare Online Rate Quotes

If you haven't shopped for car insurance for awhile you might remember the days when the only option was to visit a local insurance agent. But now you can eliminate that hassle and buy online!

The first step to finding lower Toyota Highlander rates is to get quotes from all the major car insurance companies. This is fast and easy and only requires you to complete one form.

Compare rates now by clicking the link below. In just a few minutes you'll have a good idea of what insurance will cost for your Toyota Highlander.

Important Tip! In order to accurately compare rates for your Highlander, it's critical that you use the same limits and deductibles for liability and physical damage coverages like comprehensive and collision. If you use different limits, you will not be able to accurately compare rates between carriers.

Step Two: Insider Tips for Finding Cheaper Highlander Insurance

How much impact insuring your Toyota has on your wallet is controlled by many different factors. Here are some ways to reduce the negatives and improve the positives.

- Successfully completing a driver's training class can help lower your rates if your insurance company offers that discount.

- If you're over the age of 55, check to see if you qualify for a senior citizen discount. Qualification age may vary by company

- The SUV class of vehicles generally has higher insurance rates due to the higher chance that you'll drive in adverse weather conditions.

- Teen drivers are expensive to insure and the only way to lower your rates is to rate them on an older vehicle with basic liability coverage.

- Smaller claims that hardly exceed your deductible are better off not being filed with your insurance company. Policyholders with no claims enjoy lower rates than those who frequently file claims.

- If you have a high credit score, you will be rewarded with lower insurance rates. Conversely, if your credit rating is on the low site, your rates will be higher.

- If you own a home, you may get a break on your car insurance. Home ownership demonstrates financial responsibility.

- Before a comprehensive or collision claim is paid by your company, you have to pay a deductible first. The more you're willing to pay, the lower your rates will be. Consider raising your deductibles to $500 or even $1,000.

- Most Toyota vehicles come with standard safety features such as air bags and passive restraints, and those will help keep your insurance costs down.

- Speeding and other minor violations can impact your car insurance rates for up to three years. The increased cost can easily exceed the fine and court costs for the original ticket.

- Letting your car insurance expire without having new coverage in place is called a "lapse" and will cause your next policy premiums to be higher.

- If your Highlander ranks on the list of vehicles that are frequently stolen, that can result in a higher rating class and a more expensive rate.

Step Three: Finalize your Car Insurance Policy

Now that you hopefully have several rates to compare and have made any changes needed to your individual coverages, you can choose the best company to insure your Highlander with.

An important thing to keep in mind when buying a new policy is you want the effective date of the new policy to be the exact same as the date you are cancelling your old policy.

Any time you buy a new vehicle, make sure you have car insurance in place, either from an existing policy or a new policy that you purchase from the dealership floor. Coverage that extends from an existing policy is only as good as your current coverage. So if you don't carry full coverage on any vehicles, you won't have it on your new Highlander.

Upon completion of buying your policy, you need to print out the financial responsibility card that must be kept in your vehicle at all times. Replace any old cards and promptly replace expired cards. If you have received a DUI, reckless driving citation or caused an accident without insurance, you may be required to file an SR-22 with your state DMV. Make sure your new company is aware of the SR-22 filing requirement.

More Resources

The Insurance Information Institute has a great resource of car insurance articles where you can learn more about coverages and money saving tips. Visit iii.org.