How to Save on Insurance for your Yugo GV

If finding cheaper car insurance was fun, we'd make the time to do it regularly. But unfortunately, it's difficult for a lot of people and we always seem to pay more than we should. Finding insurance for your Yugo GV that you can actually afford is probably no different.

Step One: Compare Apples-to-Apples Quotes

Up until about ten years ago, the only way to shop for car insurance was in the office of a local insurance agent where you'd get a hard sell into a policy. Now you can compare rates and buy a policy online!

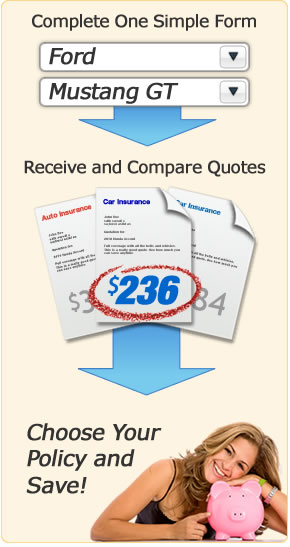

All the major car insurance companies sell insurance for a Yugo GV and you can compare their rates by entering your information only one time.

To compare rates now, have your current policy handy (if you have one) and click the link below. Complete the short form and move on to step two.

Important! If you already have liability and physical damage coverage on your GV, it's important to keep the same limits and deductibles throughout the quote process. This allows you to fairly compare rates for many companies. If you use different limits and coverages for each quote, you won't be able to judge if the final rate is better or worse than other quotes.

Step Two: How to Save on GV Insurance

There are many factors that actually determine what you will pay for insurance, and some are completely within your control.

- Each year make a habit of checking your credit score. If you find problems that may be dragging down your credit rating, address them immediately. This will result in significant savings on car insurance.

- Ask your insurance company if there is a discount for completing a driver's safety course. It may get you up to a 10% discount at your next renewal.

- Having any gaps in coverage (known as a lapse) is bad in the eyes of any insurance company. Make sure you keep coverage in force at all times by synchronizing the expiration and effective dates of your policies.

- If you own a home, you may get a break on your car insurance. Home ownership demonstrates financial responsibility.

- Being a senior citizen can qualify you for a small discount on your insurance rates. Older drivers are generally more cautious so they get a lower rate.

- Before a comprehensive or collision claim is paid by your company, you have to pay a deductible first. The more you're willing to pay, the lower your rates will be. Consider raising your deductibles to $500 or even $1,000.

- The easiest way to INCREASE your car insurance rates is to add a teenage driver to your policy. There aren't many ways to prevent a rate increase, but if you can rate them on an older vehicle, it can help.

- Speeding not only costs you a fine, a single ticket will raise your car insurance rates for up to three years. Slow down and be a safe driver and you'll pay lower rates.

- Safety features such as passive restraints and air bag systems help reduce injuries in and accident, and car insurance companies will charge lower rates if these features are present.

- To keep your rates low, don't file excessive claims on your policy. Insurance is meant to cover large losses, not small damage that you can pay for out-of-pocket.

- Vehicles that tend to get stolen or have high repair costs will cost you more to insure. If your GV falls into either category, it could cost you.

Step Three: Bind Coverage and Cancel your Old Policy

If you have found a good price by comparing quotes and also made informed decisions regarding policy limits, deductibles and other policy options that are available, you can now purchase the policy and bind coverage.

If you didn't have a prior policy, then you can make the new policy effective any time. But if you're moving bewteen companies and don't want a lapse in coverage, make sure the effective date of the new policy is exactly the same as the cancellation date of the old policy.

If the Yugo GV is a new purchase and you already have car insurance, then you will have some coverage that extends to the vehicle. But if you let your old policy lapse or have never had coverage, you don't have any protection once you buy the vehicle. When driving off the lot, you may have coverage that extends from your current policy. But it will only be equal to the most coverage you have on any vehicle. So if you only carry liability coverage, you won't be covered for full coverage until you specify it on your policy.

After completing your policy purchase, you can print out the proof-of-insurance card to place in your car. Always keep the current card available in case requested by law enforcement or if you are in an accident. High risk drivers may be required to submit an SR-22 with their state DMV's. If you have been convicted of reckless driving, DUI or had an uninsured accident, you may qualify. Make sure your new policy reflects the need for the SR-22 filing.

More Resources for Insurance Buying

For more information on car insurance, please visit the Insurance Information Institute's auto insurance informational page.